5|Empowerment, supply chain and networks |

|

Empowerment, supply chain and networks: instruments to improve our own business through the construction of a sustainable competitive advantage.

As we have already seen, empowerment is an epistemological concept. It uses techniques and/or instruments to create a new operative approach in various fields of application.

In order to confront continuous changes due to the multiple necessities present in evolving environmental conditions, a flexible organizational approach is needed.

Taking for granted that the characterising factors of today's business environment are globalisation, fast rhythms of change, a significant level of uncertainty and the need for flexibility.

Philip Kotler [1] writes: “Traditionally, companies preferred buying from a variety of suppliers, in order to cause competition between them and by doing so to achieve better concessions and discounts.

However companies were missing the high expenses caused by this system: it was necessary to monitor each supplier, the quality of products/services was variable from one supplier to the other, and none of them was ready to make substantial investments, knowing he could have risk exclusion at any time.

Nowadays companies have finally started to recognise the benefits of relying on fewer but better suppliers, capable of sharing the operational management through inter-functional teams, capable of controlling processes relying on their own specialisation and their core business.

Therefore, suppliers have turned into partners willing to make more investments, to participate at the production phases of products or services, to be ready and reliable even in difficult moments or to handle possible emergencies.

This way, day by day, Networks are rapidly increasing.

Michael Porter [2] stimulates companies who want to be successful on the market to develop sustainable competitive advantages.

In literature, competitive advantages are classified in three macro-areas:

A competitive strategy aimed at gaining a life-long duration, has to be sustainable.

Therefore it has to:

The development of a sustainable competitive advantage can be obtained through a careful analysis of the value chain. It is possible to control the Competitive Advantage in the following ways:

A competitive advantage often derives from connections between various activities, but also from individual activities.

A sustainable competitive advantage also derives from having a work team distinguished for its uniqueness and originality, made by different human resources each one of them leading its operative field and capable of an inter-functional cooperation. It is clear that an effective management and training of human resources has to be a primary feature for the company.

Training is the link between the company and the work force, as it is the main instrument for the workers' professional and personal growth. This leads to a consequential enrichment of necessary competences needed for adaptation to a competitive environment.

The majority of the companies, in the last 20/25 years, were inspired, in the definition of their competitive strategies, to business management models which became traditional [3] over time.

The majority of these is living a profound crisis.

As we have already seen, empowerment is an epistemological concept. It uses techniques and/or instruments to create a new operative approach in various fields of application.

In order to confront continuous changes due to the multiple necessities present in evolving environmental conditions, a flexible organizational approach is needed.

Taking for granted that the characterising factors of today's business environment are globalisation, fast rhythms of change, a significant level of uncertainty and the need for flexibility.

Philip Kotler [1] writes: “Traditionally, companies preferred buying from a variety of suppliers, in order to cause competition between them and by doing so to achieve better concessions and discounts.

However companies were missing the high expenses caused by this system: it was necessary to monitor each supplier, the quality of products/services was variable from one supplier to the other, and none of them was ready to make substantial investments, knowing he could have risk exclusion at any time.

Nowadays companies have finally started to recognise the benefits of relying on fewer but better suppliers, capable of sharing the operational management through inter-functional teams, capable of controlling processes relying on their own specialisation and their core business.

Therefore, suppliers have turned into partners willing to make more investments, to participate at the production phases of products or services, to be ready and reliable even in difficult moments or to handle possible emergencies.

This way, day by day, Networks are rapidly increasing.

Michael Porter [2] stimulates companies who want to be successful on the market to develop sustainable competitive advantages.

In literature, competitive advantages are classified in three macro-areas:

- Cost Leadership: a company chooses to become the producer with the lowest expenses in its sector. Mostly this is obtained in scale economies. It is usually a disaster for all companies, if more of them choose to become low budget producers.

- Differentiation: a company tries to be unique in its sector basing on factors that are widely and simply appreciated by its clients. A differentiation strategy cannot underestimate expenses. For each area excluded from its own differentiation, the company has to lower expenses in order to keep earnings from trademark acknowledgement.

- Focus on specialisation: a company chooses to be the best in one or many sectors.

A competitive strategy aimed at gaining a life-long duration, has to be sustainable.

Therefore it has to:

- build barriers against competitors to make the imitation process harder;

- make investments aimed to innovating the production processes of products and services, in order to continuously improve its position for the innovation of the product/service, ensuring the quality and the satisfying client management;

- constantly observing the sector's evolution.

The development of a sustainable competitive advantage can be obtained through a careful analysis of the value chain. It is possible to control the Competitive Advantage in the following ways:

- Protecting those activities aimed at creating value and which are needed to succeed in the factors they compete for;

- Holding or cancelling those activities that can be a risk for the value, causing expenses that will not be covered by the final buyer;

- Reconfiguring the chain of values, innovating processes or internalising/externalising some activities.

A competitive advantage often derives from connections between various activities, but also from individual activities.

A sustainable competitive advantage also derives from having a work team distinguished for its uniqueness and originality, made by different human resources each one of them leading its operative field and capable of an inter-functional cooperation. It is clear that an effective management and training of human resources has to be a primary feature for the company.

Training is the link between the company and the work force, as it is the main instrument for the workers' professional and personal growth. This leads to a consequential enrichment of necessary competences needed for adaptation to a competitive environment.

The majority of the companies, in the last 20/25 years, were inspired, in the definition of their competitive strategies, to business management models which became traditional [3] over time.

The majority of these is living a profound crisis.

From a study

conducted by Foster and Kaplan, only 74 of the 500 leading US companies in the

S&P list in 1957, are still leading in 1997.

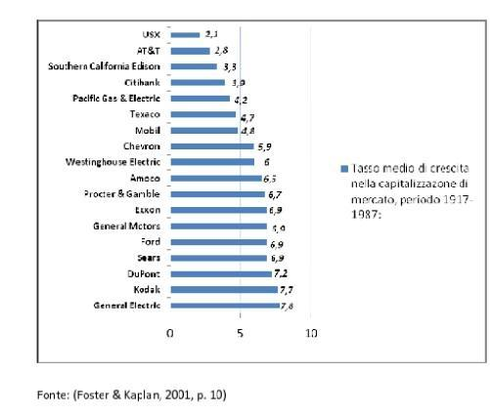

The McKinsey database, which holds the performances of 1008 companies, which belong to 15 product category, analyzes a scope of almost 40 years, from 1962 to 1998, in which only 160 companies can be found from the beginning until the end of the considered period. In 1917 Forbes compiled the first ranking of the Top 100 companies in the US, which were classified by asset; in the 1987 ranking, of the 100 companies of 1917, 61 companies ceased to exist and among the remaining 39, only 18 were able to stay in the top 100. The investors have earned -20% from the survived companies, in the 1917-1987 period. Only two of the companies, GE and Kodak, have actually showed a growth of the average rate of the market capitalization, respectively 7.8 and 7.7%.

In 2020 the ¾ of the S&P 500 Index will be made up of companies which we don’t even know today.

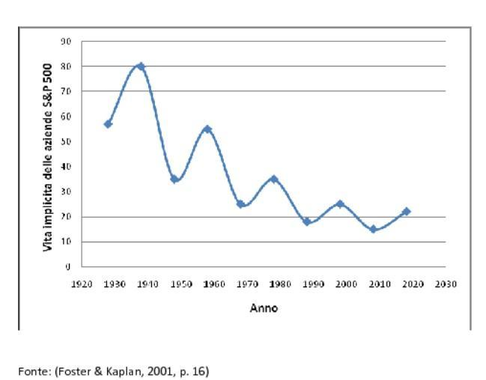

The permanence time of a company in the S&P 500 list was tragically reduced, going from a 65 years expectancy during the 20’s to an expectancy between 10 and 20 years in the recent period.

From this data we understand that the excellent company simply does not exist, and that the companies are not capable of have the best market performances for more that 10-15 years.

The companies described in the Search of Excellence (1988, Peters and Waterman) are no longer perfectly managed as they were before.

How come? A possible answer can come from the analysis of the traditional way of competing and integrating the competitive strategy with a strategic thought , so called “traditional”.

Major economists link empowerment in new companies to the utility of new instruments and methodologies of strategic business management, as the right feature to use in companies that aim to renew themselves. The strategies can either be networking, supply chain or lean production, and companies are here understood as small or large, as long as they have understood the changes in all sectors of the economy.

Thanks to the growing availability and speed of information, companies can obtain a real time a precise view of the general demand. They can then be tuned with the markets knowing precisely how to use their offer depending on the demand.

Information has replaced material stock, causing a renovation of the supply chain (2000, P. Kotler, D. C.Jain, S. Maesincee).

New opportunities have made possible the substitution of vertical integration with a virtual integration.

A virtual exchange of information saves time and staff expenses necessary to complete transactions of activity coordination for internal and external operators.

Therefore, a Network is created by the Client Company and by stakeholders (those who share the company's interests) with whom it has started a profitable business relationship. In new economy, competition happens less between single companies and more between Networks; the company creating a better network will always be more successful.

There is an increase in the number of industrial and service compartments that base themselves on the concept of supply chain. The concept of supply chain management is also becoming increasingly popular in today's global business.

As Harrison suggests, “companies are currently competing through supply chains”, while Gattorna states that “supply chains are the business!”

The McKinsey database, which holds the performances of 1008 companies, which belong to 15 product category, analyzes a scope of almost 40 years, from 1962 to 1998, in which only 160 companies can be found from the beginning until the end of the considered period. In 1917 Forbes compiled the first ranking of the Top 100 companies in the US, which were classified by asset; in the 1987 ranking, of the 100 companies of 1917, 61 companies ceased to exist and among the remaining 39, only 18 were able to stay in the top 100. The investors have earned -20% from the survived companies, in the 1917-1987 period. Only two of the companies, GE and Kodak, have actually showed a growth of the average rate of the market capitalization, respectively 7.8 and 7.7%.

In 2020 the ¾ of the S&P 500 Index will be made up of companies which we don’t even know today.

The permanence time of a company in the S&P 500 list was tragically reduced, going from a 65 years expectancy during the 20’s to an expectancy between 10 and 20 years in the recent period.

From this data we understand that the excellent company simply does not exist, and that the companies are not capable of have the best market performances for more that 10-15 years.

The companies described in the Search of Excellence (1988, Peters and Waterman) are no longer perfectly managed as they were before.

How come? A possible answer can come from the analysis of the traditional way of competing and integrating the competitive strategy with a strategic thought , so called “traditional”.

Major economists link empowerment in new companies to the utility of new instruments and methodologies of strategic business management, as the right feature to use in companies that aim to renew themselves. The strategies can either be networking, supply chain or lean production, and companies are here understood as small or large, as long as they have understood the changes in all sectors of the economy.

Thanks to the growing availability and speed of information, companies can obtain a real time a precise view of the general demand. They can then be tuned with the markets knowing precisely how to use their offer depending on the demand.

Information has replaced material stock, causing a renovation of the supply chain (2000, P. Kotler, D. C.Jain, S. Maesincee).

New opportunities have made possible the substitution of vertical integration with a virtual integration.

A virtual exchange of information saves time and staff expenses necessary to complete transactions of activity coordination for internal and external operators.

Therefore, a Network is created by the Client Company and by stakeholders (those who share the company's interests) with whom it has started a profitable business relationship. In new economy, competition happens less between single companies and more between Networks; the company creating a better network will always be more successful.

There is an increase in the number of industrial and service compartments that base themselves on the concept of supply chain. The concept of supply chain management is also becoming increasingly popular in today's global business.

As Harrison suggests, “companies are currently competing through supply chains”, while Gattorna states that “supply chains are the business!”

But what makes supply

chains so important?

Partner companies join and make a productive critical mass system based on the concept of a Cooperative Networking Environment. They can now fully engage in what they specialise in, each one of them working in their own confined sector. By doing so, they will be capable of competing for projects they previously couldn't afford to compete for.

Each partner's approach is aimed to creating a system based on the concept of blockmodeling (White, Boorman & Breiger, 1976). This is to highlight in a network the creation of sub-groups with their own characterised features, placed in a structural position similar to the knots of a network. It is intended as a “role” covered by subjects who, though not connecting with each other, are distinguished by having a similar structural relationship.

Such a structure is about the relationship of these subjects with all the other knots in the network (Lorrain & White, 1971) and consequentially with the main Network, which acts with the same behaviour in its “relationship projection” with the “external world”: the Objective Market.

As seen, in the 21st century industry the competition on particular markets can be sustained through the adoption of evolved logistic-productive systems. Today’s drastic increase of the environmental complexity obliged the companies to morph their competitive approach and to find new referring paradigms. The manufacturing companies, in fact, faced the revolutionary changings, brought from the increasing capacities of IT, which reduced the distances and broke down the boundaries between markets and gave management very effective instruments for control/planning, design and costumer care.

While all of this was happening, the structure of big multinational companies was starting to disintegrate towards reticular forms; due to competitive pressure, the big enterprises preferred in fact to dedicate to their core business externalizing all the rest.

In addition, the pressure made from the regional markets pushed the enterprises to reorganize and create, produce and distribute goods and services for the single geo-cultural areas. The result of this has been the increase of the supply chains and the dependence of the companies to these. International literature reports different tendencies to which the companies’ logistic-productive system had to and will adapt (Frederix, 2004; Gou, Luh e Kyoya, 1998; Nagel e Dove, 1991; Suda 1989 e 1990) :

· The productive system is crossing a changind perios of the paradigm of mass production to “semi-personalized” production to the aim of meeting increasing differences of the demand;

· The tendency to “home-make” is gradually changing towards a new opening to the collaboration with other subjects finalized to speed up of the developing processes of products and production

· The effective and efficient capacity of cooperating becomes a critical factor for the following success of the company inside the networks; the control centralized from the different entities with different information, experiences, decisional authority and objectives is almost impossible. Efficient and effective cooperation became a key challenge for those organizations that want to flourish in more and more competitive environments.

To compete, supply chains have to be:

The internal characteristics of some compartments of economy like the one in the digital industry in particular, impose the choice of organizing solutions capable of easing the continuous improvements throughout continuous change.

The will of Rebel Alliance to apply this vision for implementing a modern and agile productive system is focused towards the holistic productive approach.

Partner companies join and make a productive critical mass system based on the concept of a Cooperative Networking Environment. They can now fully engage in what they specialise in, each one of them working in their own confined sector. By doing so, they will be capable of competing for projects they previously couldn't afford to compete for.

Each partner's approach is aimed to creating a system based on the concept of blockmodeling (White, Boorman & Breiger, 1976). This is to highlight in a network the creation of sub-groups with their own characterised features, placed in a structural position similar to the knots of a network. It is intended as a “role” covered by subjects who, though not connecting with each other, are distinguished by having a similar structural relationship.

Such a structure is about the relationship of these subjects with all the other knots in the network (Lorrain & White, 1971) and consequentially with the main Network, which acts with the same behaviour in its “relationship projection” with the “external world”: the Objective Market.

As seen, in the 21st century industry the competition on particular markets can be sustained through the adoption of evolved logistic-productive systems. Today’s drastic increase of the environmental complexity obliged the companies to morph their competitive approach and to find new referring paradigms. The manufacturing companies, in fact, faced the revolutionary changings, brought from the increasing capacities of IT, which reduced the distances and broke down the boundaries between markets and gave management very effective instruments for control/planning, design and costumer care.

While all of this was happening, the structure of big multinational companies was starting to disintegrate towards reticular forms; due to competitive pressure, the big enterprises preferred in fact to dedicate to their core business externalizing all the rest.

In addition, the pressure made from the regional markets pushed the enterprises to reorganize and create, produce and distribute goods and services for the single geo-cultural areas. The result of this has been the increase of the supply chains and the dependence of the companies to these. International literature reports different tendencies to which the companies’ logistic-productive system had to and will adapt (Frederix, 2004; Gou, Luh e Kyoya, 1998; Nagel e Dove, 1991; Suda 1989 e 1990) :

· The productive system is crossing a changind perios of the paradigm of mass production to “semi-personalized” production to the aim of meeting increasing differences of the demand;

· The tendency to “home-make” is gradually changing towards a new opening to the collaboration with other subjects finalized to speed up of the developing processes of products and production

· The effective and efficient capacity of cooperating becomes a critical factor for the following success of the company inside the networks; the control centralized from the different entities with different information, experiences, decisional authority and objectives is almost impossible. Efficient and effective cooperation became a key challenge for those organizations that want to flourish in more and more competitive environments.

To compete, supply chains have to be:

- Agile, meaning capable of response to the short-period changes of demand or supply and manage easily the external turbulences

- Adaptable, capable of adjusting their structure to meet the change of the market, so capable of modifying the structure of the networks of the supply chain in function of strategie, technologies and/or products;

- Aligned, through a system of uniform incentive, finalized to the constant reaching of the common objectives.

The internal characteristics of some compartments of economy like the one in the digital industry in particular, impose the choice of organizing solutions capable of easing the continuous improvements throughout continuous change.

The will of Rebel Alliance to apply this vision for implementing a modern and agile productive system is focused towards the holistic productive approach.

[1] full professor of economy at the Kellogg School of Management - Northwestern University, who, between 1967 and 1971, determined the structure of “marketing” as a scientific discipline

[2] full professor at Harvard Business School

[3] According to the traditional strategic thought, before defining a strategy, managers have to agree about the aims of the company - the mission, the future results to which aspire - the vision, and the internal compass which will guide their actions - the values (2008, Kaplan and Norton). The mission is a brief declaration, which is generally made up of one or two sentences, which defines the reasons why the company exists and especially what it has to offer to the different clients. a good example is Novartis, the big pharmaceutical company: <<we want to discover, develop and sell, successfully, innovative products to prevent and heal diseases, alleviate the suffering of patients and improve the quality of their lives. we also want to assure great yield to our investors and properly reward people who believe and invest ideas and energies in our company>>. The vision is a concise declaration which defines the objectives of the company on a medium-long term (3-10 years). The values (also known as core values) of a company describe the attitude, the behavior and the nature of the company. The declarations which are part of the building values of a company, which are often pretty long, describe the desirable behaviors which the company wants to promote. Cavalieri (2007) defines the strategy as “an ensemble of actions which tend to realize as much as possible the prospective compatibility between organizational and operative structures and the environment in which the activity of the company will develop”. Dominance, flexibility and integration represent the great directors towards which the companies’ strategies are aimed to face the risks of environmental variability, stiffness of the organizational structures and the internal variability. According to the traditional strategic thought, the competitive strategy is defined as the research of the competitive advantage as a condition of success, through a set of activities aimed to grant a compatibility between the specific capacities of a company and a the competitive exigencies of a segment, so to fix a strategic positioning which can be long-lasting and sustainable over time. Together with Porter’s contribution, which defines the attractivity of a segment as main factor of the success of a company, together with the particular position gained by the company itself in the aforesaid segment, we have to keep in mind also of an internal/external perspective which examines internal resources, capacities and skills of the company. These approaches are two faces of a single complexive competitive framework, in which the first is concentrated on the definition on which can be the competitive advantages on which we have to create the success on a specific segment, the second, on how to create them: from the integration of the analysis according to the internal/external and external internal perspectives, keeping in mind its country of origin and the behavior of the competitors, the company defines its competitive strategy. The system of the complex modes through which the company is capable of coordinating the internal forces is defined as organizational structure. The composition of investments and sources, as well as the system of complex modes through which the company is capable of performing the necessary activities to realize their own productive coordinations, is defined as operative structure.